Corporate scams are now a major problem for investors, corporations, and authorities all around the world. These scams cost organisations money, but they also harm their brand and undermine public trust. In order to reduce the danger of such frauds, this study paper suggests prevention techniques as well as identifies the reasons and types of corporate frauds. To comprehend the impact of corporate frauds and their effects, the paper analyses a number of case studies.

Introduction:

Corporate

fraud is the deliberate falsification or manipulation of financial information,

accounting records, or other commercial activities by one or more people or

organisations inside an organisation. These dishonest practises have the

potential to harm the company's brand and public trust, as well as result in

large financial losses for stakeholders including shareholders, employees, and

other parties. Businesses lose an estimated 5% of their annual income to fraud,

says a survey by the Association of Certified Fraud Examiners.

Causes

of Corporate Frauds:

Corporate

frauds can be brought on by a number of things, such as greed, financial

targets that must be met under pressure, lax internal controls, a lack of moral

principles, and insufficient management or board of director oversight. In some

instances, fraudsters use flaws in the organization's systems and procedures to

carry out their crimes.

Types

of Corporate Frauds:

Financial

statement fraud, asset theft, bribery and corruption, insider trading, and

cybercrime are just a few examples of the many ways that corporations commit

fraud. Financial data are manipulated in financial statement fraud in order to

falsely improve the company's performance. Theft of firm assets, such as money,

goods, or intellectual property, is referred to as asset misappropriation. The

use of questionable money or gifts to achieve a competitive edge in business is

bribery and corruption. The practise of trading stocks for personal gain while

using insider knowledge is known as insider trading. The use of technology to

commit fraud, such as phishing scams, identity theft, or hacking, is known as

cybercrime.

Notable

Corporate frauds:

1) Enron: Enron was a Houston-based

energy company that filed for bankruptcy in 2001 after it was discovered that

the company had engaged in widespread accounting fraud. The company had

inflated its earnings by manipulating its financial statements and hiding debt.

2) WorldCom: WorldCom was a

telecommunications company that filed for bankruptcy in 2002 after it was

discovered that the company had engaged in accounting fraud. The company had

inflated its earnings by over $11 billion by manipulating its financial

statements.

3) Bernie Madoff Ponzi Scheme: Bernie

Madoff was a former stockbroker and investment advisor who was sentenced to 150

years in prison for running a Ponzi scheme that defrauded investors of billions

of dollars. Madoff had promised investors high returns but used new investor

money to pay off earlier investors.

4) Tyco: Tyco was a multinational

conglomerate that was involved in a series of accounting scandals in the early

2000s. The company's CEO, Dennis Kozlowski, was convicted of fraud and

conspiracy after he used company funds for personal expenses, such as art

purchases and extravagant parties.

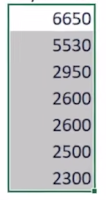

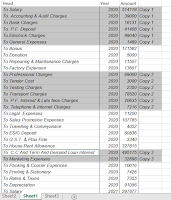

5) Satyam: Satyam was an Indian IT

services company that was involved in a massive accounting scandal in 2009. The

company's founder, Ramalinga Raju, admitted to inflating the company's earnings

by over $1 billion and falsifying its accounts.

Prevention

Strategies:

A

multifaceted strategy combining detective and preventive measures is needed to

prevent corporate fraud. Strong internal controls, regular audits, supporting

moral principles, educating staff members about fraud, and ensuring that

management and boards of directors have sufficient oversight are just a few of

the preventive measures. Detective controls involve keeping an eye on and

spotting fraud activity through data analytics, tip lines, and forensic audits.

Conclusion:

Business

entities and their stakeholders are at substantial risk from corporate fraud.

Implementing prevention techniques and identifying the forms and causes of

corporate fraud can help reduce the likelihood of such frauds. To protect their

reputation and financial stability, organisations must give priority to fraud

prevention and detection while fostering a culture of ethical values and

openness.